All forces in an economy are driven by transactions so if we can understand transactions we can understand the whole economy. A market consists of all the buyers and all the sellers making transactions for the same thing.

For example, we have the meat market, a car market, the stock market, and markets for millions of things. An economy consists of all of the transactions in all of its markets. If you add up the total spending and the total quantity sold in all of the markets you have everything you need to know to understand the economy.

It’s just that simple! people, businesses, Banks, and governments engage in transactions the way I just described. They exchange money and credit for goods, services, and financial assets.

The biggest buyer and seller is usually the government, which consists of two important parts a central government that collects taxes and spends money, and the central bank which is different from other buyers and sellers because it controls the amount of money and Credit in the economy. This is how we can understand how interest rates have certain trends.

Lenders and Borrowers and Their Impact on Intrest

I want you to pay attention to credit! Credit is the most important part of the economy and probably the least understood. It’s the most important part because it’s the biggest and most volatile piece.

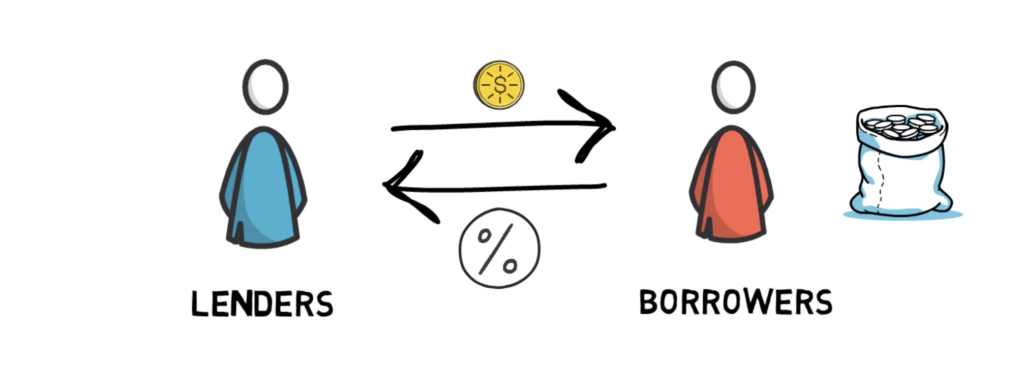

Just like buyers and sellers go to the market to make transactions, so do lenders and borrowers. Lenders usually want to make their money into more money, and buyers usually want to buy something they can’t afford like a house or a car or they want to invest in something like starting a business.

Borrowers promise to repay the amount they borrow called principal plus an additional amount called interest. When interest rates are high there is less borrowing because it’s expensive when interest rates are low borrowing increases because it’s cheaper.

2. The Effect Debt and Credit has on Economic Cycles :

Spending drives the economy because one person’s spending is another person’s income. Every dollar you spend someone else earns and every dollar you earn, someone else’s spends. Therefore, when you spend more someone else will earn more, when someone’s income rises it makes lenders more willing to lend that person money.

This is because now he’s more worthy of credit! A creditworthy person has two things: the ability to repay, and collateral. Having a lot of income in relation to dept gives him the ability to repay in the event that he can’t repay through his income.

He has valuable assets to use as collateral that can be sold, this makes lenders feel comfortable lending money. Therefore, increased income allows increased borrowing which allows increase spending, and since one person’s spending is another person’s income this leads to more increased productivity.

This will cause a self-reinforcing pattern that leads to economic growth and is why we have Cycled.

3. The effect Economic Cycles has On Intrest Rate Trends:

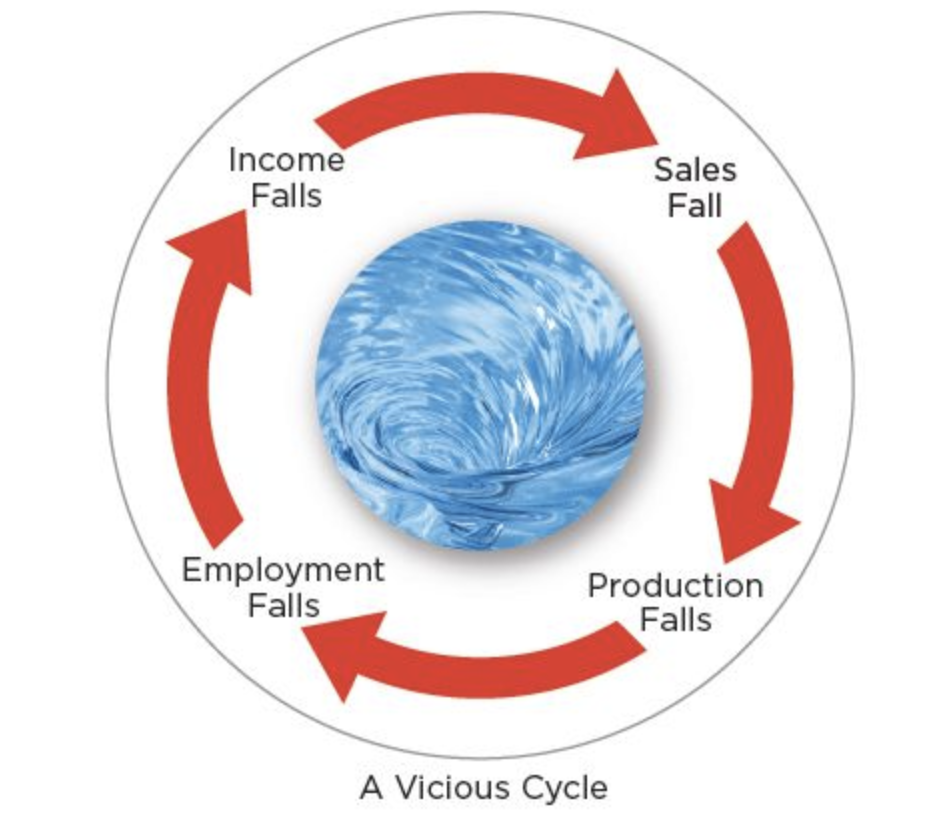

When the amount of spending and incomes grow faster than the production of goods prices rise. When prices rise we call this inflation, and the central bank doesn’t want too much information because it causes problems.

Seeing these rising prices, the government raises interest rates. With higher interest rates, fewer people can afford to borrow money and the cost of existing debts Rises. This will of course cause spending to slow which will decrease economic trade and a deflationary period occurs.

This deflation will cause prices to fall making inflation no longer a big problem to the economy and causing a recession. If the recession becomes too severe and inflation is no longer a problem the central bank will lower interest rates to cause everything to pick up again.

With low interest rates, debt repayments are reduced, and borrowing and spending pick up and we see another expansion. Finally, this is how the economy is correlated with interest rates and how the federal government controls interest rates based on economic cycles that are very predictable.

One thought on “Interest Rates and Their Impact On The Economy”