Some people might be asking why does stock market crash? and when will the stock market crash again? Let’s be honest here, predicting exactly when and where the market recession will happen in the future is practically impossible unless I had some Insider information. All that I can do is take past data and statistics and apply them to our present situation. Let’s get straight into it and start analyzing past markets:

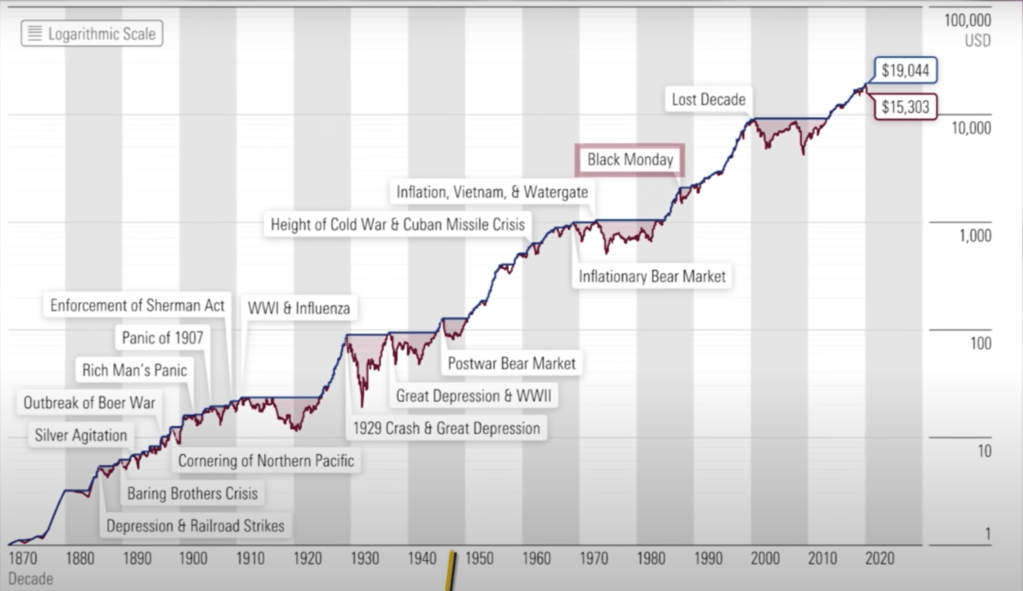

1. History of Market Cycles

During the past 150 years, there have been many Market cycles that have occurred, a lot of Bull and Bear markets that we can analyze and draw parallels to our current situation. The most well-known market crash in history was the 1929 crash and Great Depression. Others include Black Monday, the Lost Decade, the 2008 financial crisis, inflation in the Vietnamese War, the post-war bear market after World War II, etc.

The big takeaway of the past 150 years is that market Cycles tend to go to negative bear markets every 8 to 10 years. If we remember the last market crash is being the 2008 financial crisis we can easily identify that this is an outlier to the rule above. It has been almost 13 years since the last financial crisis as of the time writing this post. But it also indicates that the next recession could very well be around the corner.

2. Unemployment Rate

the graph below outlines the unemployment rate in the last 70 years of Market history. You can clearly see that the unemployment rate in 2020 has spiked higher than in the last 70 years. This indicates that if unemployment rates stay the same that they are today, there is an extremely high likelihood that the economy will suffer resulting in an economic crisis or a recession. This is because when a lot fewer people are working than in previous years it is very hard to sustain the past output produced in previous years. Resulting in a market Slowdown, which will decrease investor satisfaction and confidence in the market, which will make the market crash.

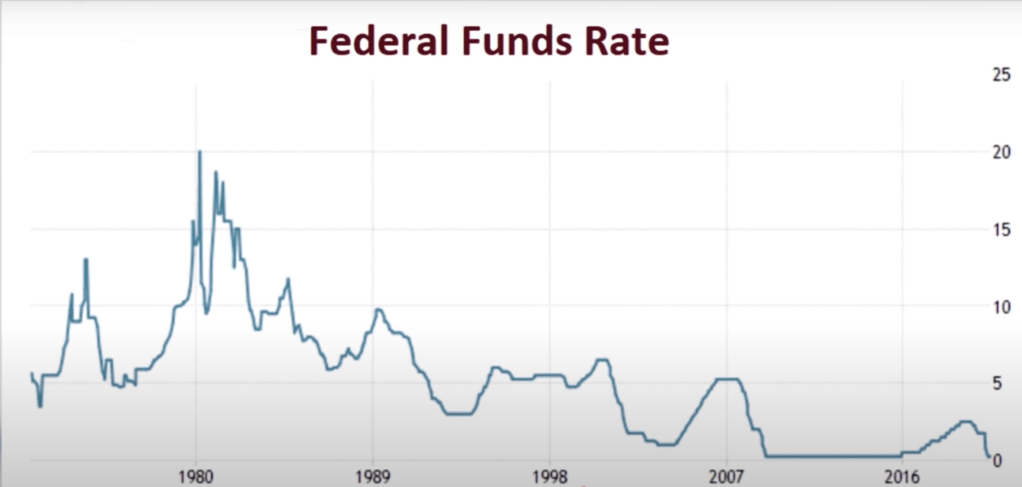

3. Intrest Rates

I personally believe that interest rates are the only thing holding the stock market together at this point. Both the history of Market cycles and unemployment rate indicate that there should be an economic recession happening as you read this blog. But since the Trump Administration has said to print a lot more money into the system and stimulate the economy artificially, in addition to decreasing interest rates to near-zero levels the market has no choice but to keep going up even though the economic situation is dire. When interest rates are near zero level it incentivizes investors to borrow money to keep creating wealth and to buy assets.

This higher volume of purchases will cause inflation in the market. We are already seeing the result of this inflation in gas prices lumber prices and prices of multiple things in today’s market in the United States. When the feds seize this hyperinflation eventually they will be forced to increase interest rates to more adequately high levels in order to calm down the economy and to calm down prices in order to maintain the value of the United States dollar. I believe that when the FED eventually increases interest rates to 8% or higher that is when the markets crash will happen.