It’s true that as a smart investor you will long term goals and you make sure investing satisfy those goals in the long term. However, it is also true that people also have short-term goals that you want to satisfy. This can include things like planning a vacation, buying a new phone, affording a new laptop, etc. Therefore, it is very relevant to be able to manage money on a short-term basis in order to satisfy those goals.

Short Term Goals

This can be categorized by the tenure of goals and the importance of the goal. Tenure is very important to consider when deciding on a short-term investment strategy to satisfy your goals. As you can see in the chart below, there could be emergency goals, ultra short term goals, and short term goals that are time-dependent. Therefore, the first thing you should do is to list out your short-term goals and categorize them based on tenure. Also, it is very necessary to identify whether your goal is important or not. Categorizing your importance will allow you to understand which problem to tackle first.

Selection Criteria for Short Term Investments

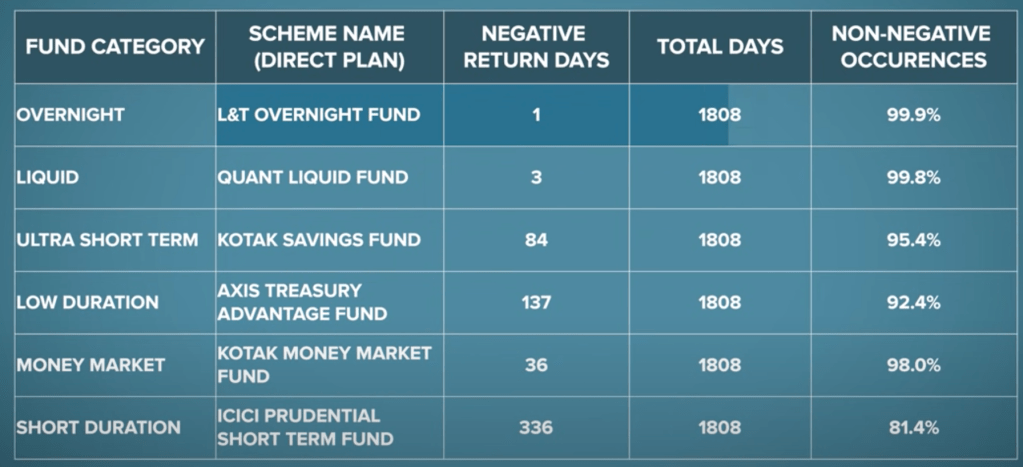

there are two criteria to look for when identifying assets that will be used for short-term gains and uses. They are safety of capital, liquidity or accessibility, and potential Returns. Different asset classes carry different levels of risk, while there is always going to risk it is also important to understand the extent and practicality of the risk. If your short-term goals include maximum safety, you can consider the chart below for non-negative days. In that case, the best strategy for nonnegative is an overnight fund which basically has almost zero waste of money. Next, we need to consider liquidity, the fastest mode of accessing money, in this case, would be a bank savings account as it allows for online bank transfers and withdrawals. The next most accessible mode for liquidity will be a fixed deposit which is optimal to be used for short-term needs such as buying a phone or a laptop.

Considering Returns to Risk

Finally, we should also consider the returns and what one should look for is a return that is better than a regular savings account or a fixed deposit account. As shown in the chart below the higher the interest rates the more favorable it is to get a savings account or a government-issued bond. On the other hand, when interest rates are extremely low, debt funds don’t perform up to par with investor satisfaction (2020, 2021).