There are many low-risk investment options available, and each has its own advantages and disadvantages. Here are seven low-risk investments that you could consider

Certificates of Deposit (CDs):

A CD is a savings account offered by banks that pays interest rates higher than those on traditional savings accounts. In order to open a CD, you must deposit a fixed amount of money for a set period of time. The time can range anything between six months to a year. The longer the term, the higher the interest rate.

Advantages: CDs offer relatively high-interest rates; they’re insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor per bank, and they can be easily opened with as little as $500.

Disadvantages: CDs don’t offer the liquidity of a savings or checking account; you can’t withdraw your principal without paying an early withdrawal penalty, which is not outlined in advance and varies from bank to bank; and there’s no guarantee that rates will rise while your money is locked up.

U.S. Savings Bonds (I-Bonds)

- I-bonds are low-risk investments sold by the U.S Treasury through banks and other financial institutions that come with built-in inflation protection, meaning their value rises over time as prices increase due to inflation. They’re backed by the full faith and credit of the United States government, so they provide some measure of safety for investors who may be concerned about stock market volatility or economic downturn.

Advantages: I-bonds offer a guaranteed return and they’re exempt from state and local taxes. They can be purchased for as little as $25, and the bonds’ rates rise overtime to keep up with inflation so their value doesn’t fall; you don’t have to pay any fees or commissions when purchasing them; and if held for at least five years, I-bonds earn an interest rate that includes a one-time adjustment (if applicable) based on changes in inflation.

Disadvantages: I-bonds are not marketable; you cannot cash them early without paying penalties; there’s no guarantee your investment will increase in value because it is to prevailing interest rates like those on other low-risk investments, and they can only be purchased in $100 denominations.

Money Market Accounts (MMAs)

MMAs are savings accounts that offer a higher interest rate than traditional checking or savings accounts, but with some restrictions on how much money you can deposit and withdraw.

Advantages: MMAs offer a high yield without locking up your money for an extended period of time like CDs; there’s no minimum deposit required to open an account, and most MMA accounts are FDIC insured.

Disadvantages: MMAs usually require a higher minimum balance to earn the highest interest rates available; you may be limited to six withdrawals or transfers per month, which could include checks written against the account, debit card transactions, and phone or online transfers; and there are usually fees for closing the account early.

Treasury Bills (T-Bills)

T-bills are low-risk investments that represent loans to the federal government, which means they’re considered one of the safest investment options available. They allow investors to lend money directly to the U.S Treasury in exchange for interest over a set period between one month and five years

Advantages: T-bills pay interest at regular periods with no risks involved because you’re lending your money directly to the United States Government, so it is guaranteed repayment when due; rates have been stable since their introduction with little fluctuation seen in inflationary times, and these securities can be bought through brokerage firms as well as the U.S Treasury website.

Disadvantages: T-bills are not marketable, so you cannot sell them prior to maturity; there is a small purchase fee (which can be waived if purchased through a broker); and because they’re short-term investments, you could lose out on potential earnings if interest rates rise during the time your investment is outstanding.’

Certificates of Deposit (CDs)

CDs are low-risk investments that allow investors to loan money to a bank or other financial institution for a set period of time in exchange for regular interest payments

Advantages: CDs offer relatively high-interest rates; they’re insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor per institution; and they can be purchased in a variety of maturities from three months to five years, which gives you some flexibility when it comes to choosing the length of your investment term.

Disadvantages: CDs are not marketable investments, so their rates do not fluctuate based on changes in prevailing interest rates or economic conditions; there is often a substantial penalty for early withdrawal that’s usually equivalent to six months’ worth of interest payments.

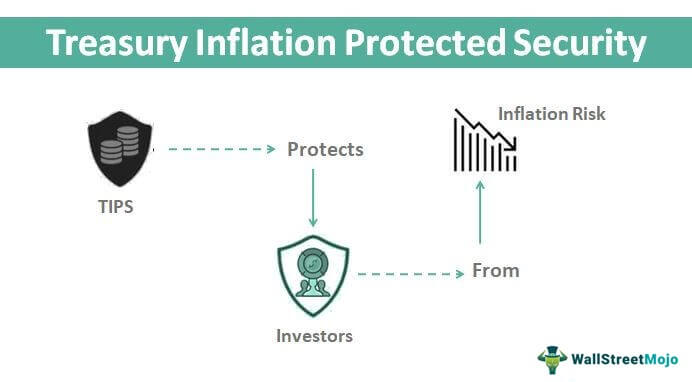

Treasury Inflation-Protected Securities (TIPS)

TIPS provides low-risk income while offering protection against inflation because these securities adjust according to changes in the Consumer Price Index. They have maturity dates between one and ten years with short- being less than five years

Advantages: TIPS are one of the few low-risk investments that offer protection against inflation; they can be purchased through a brokerage firm or directly from the U.S Treasury, and they’re relatively easy to trade.

Disadvantages: TIPs rates do not keep up with high levels of inflation, so you could lose money if prices increase more than the rate at which your security’s value increases; there is an annual purchase fee (which can be waived if purchased through a broker); and like other fixed-income securities, TIPS are susceptible to interest rate fluctuations.

Balanced Mutual Funds

Balanced mutual funds are a type of fund that invests in both stocks and bonds in order to provide investors with stability and modest growth potential. They usually have a low-risk profile because they invest in less volatile securities.

Advantages: Balanced mutual funds are one of the easiest and most common ways to invest in stocks and bonds; many of these funds offer a choice of different investment objectives, so you can find one that fits your risk tolerance; and they’re typically well-diversified, which helps to minimize your chances of losing money on any given investment.

Disadvantages: Even though balanced mutual funds have a lower risk profile than individual stocks or bonds, they’re not completely without risk; their returns may not keep pace with those achieved by investing in the securities individually, and some funds carry high fees.