Welcome to the topic Credit score 650.

A validation set that varies from 300 to 850 and represents a person’s creditworthiness is known as a credit score. A borrower’s credit score indicates how appealing they are to potential lenders. Credit history, which includes the list of open accounts, total debt amounts owed, repayment history, and other factors, determines a credit score. Lenders use credit scores to assess whether or not borrowers will be able to repay their debts on time.

The Fair Isaac Corporation, often known as FICO, developed the credit score model, which financial institutions utilize. While there are alternative credit-scoring systems, the FICO score is the most widely utilized. Individuals’ credit scores can be improved by repaying debts on time and keeping debt to a minimum.

Working of Credit Score

A credit score can have a huge influence on your financial life. It is a crucial consideration in a lender’s decision to give credit to you. People with credit scores less than 640, for example, are classified as subprime borrowers. To compensate for the added risk, lending institutions generally charge higher interest rates on subprime mortgages than on conventional mortgages. Borrowers with a low credit score may also request a shorter payback term or a co-signer.

Credit Score Factors: How Is Your Score Determined?

In the US, three major credit reporting agencies (Experian, Equifax, and Transunion) record, update, and store customer credit histories. While the information collected by the three credit bureaus may differ, there are five primary elements considered when establishing a credit score:

- History of payments

- Total sum owed

- Credit history length

- Credit Varieties

- brand-new credit

Payment history accounts for 35% of a credit score and reveals whether or not they pay their payments on time. The total amount owed accounts for 30% of the total amount owed and considers the percentage of a person’s available credit currently being used, commonly known as credit use. Credit history duration is worth 15%, with longer credit histories being less risky because there is more data to examine payment history.

The credit type used accounts for 10% of a credit score and indicates if a person has a combination of installment credit, such as vehicle loans or home loans, and revolving credit, such as credit cards. New credit is also worth 10%. It considers how many new accounts a person has, how many new accounts they have recently applied for, which resulted in credit inquiries, and when the most recent account was started.

Credit score 650: is it considered good?

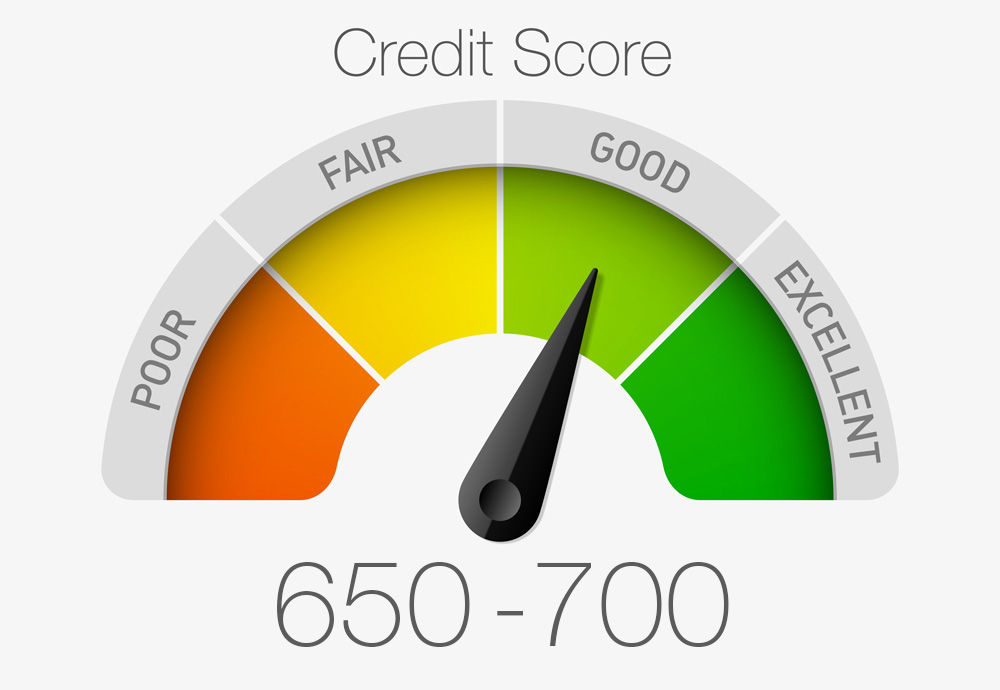

Higher scores on the FICO score scale of 300 to 850 imply more creditworthiness or a higher possibility of repaying a debt. A FICO credit score of 650 is regarded as fair—better than poor but less than excellent. It is less than the national average FICO score of 710 and sits squarely within the acceptable score range of 580 to 669. A Vantage Score scoring system score of 650 also falls within its acceptable range of 601 to 660; FICO Scores are more extensively employed in the mortgage sector. Thus we’ll focus on a 650 FICO® Score.

One thought on “Credit score 650”