In the United States, the average credit score is 706. However, unless your credit score is exactly 706, this doesn’t tell you much about your situation.

Do you want to know how you stack up against other American consumers? Here’s a glance at the current FICO score distribution, as well as some tips to assist you in interpreting what your score signifies.

Credit Score Percentile

The greatest credit score is 850. However, even the finest credit ratings fall short of this mark. If you know your FICO credit score, you may be curious about where you stand in comparison to the rest of American customers.

In addition, if you don’t know, take the time to find out by using one of the many free credit score checkers available (the Fair Isaac Corporation issues FICO credit scores—and you can easily find your credit score directly from their website, too).

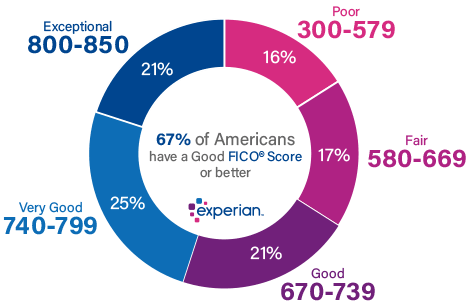

The Ascent recently completed a study that depicted the distribution of various credit ratings according to age, state, income, and other factors. Here’s how American customers feel:

| Credit Score | Percentage of America |

| 800-850 | 20% |

| 740-799 | 25% |

| 670-739 | 21% |

| 580-669 | 18% |

| 300-579 | 16% |

The average credit score in the United States

In the United States, the average FICO score is 706. However, this changes depending on several things. The majority of people’s credit scores rise over time.

Some states have average credit ratings that are higher or lower than others. Minnesotans, for example, have the highest average FICO credit score in the country, at 733.

According to this data, 55% of Americans have a FICO score of 740 or better. Historically, this has been the case, but the decade of sustained economic growth since the Great Recession has greatly improved Americans’ credit ratings.

When fewer individuals have major delinquencies (or other concerns) pulling down their credit ratings, their credit scores rise. From year to year, the status of the economy might influence whether or not people are financially able to avoid credit score issues.

What is the highest credit score possible?

In most cases, the best FICO score available is 850. It is, nevertheless, incredibly difficult to have a perfect credit score. Only 20% of American adults have a credit score of 800 or above.

Even if you have the finest credit score in the country, you may not be able to reach 850. Do you want to know how to acquire a credit score of 850? Here are some tips to help you boost your credit score and come closer to the greatest possible credit score:

- Paying off your credit card account on a regular basis

- Making corrections to your credit report

- Maintaining an old credit card, even if you don’t use it frequently

- On-time payment of your invoices

- Requesting an increase in your credit limit.

You should be proud of yourself if you have a FICO credit score of 800 or better. Raising your credit score needs perseverance, focus, and patience. Even if your credit isn’t flawless, having a high credit score is something to be proud of.

Good Credit Score Percentile:

| Credit Score | Percentage of America |

| 800-850 | Exceptional |

| 740-799 | Very Good |

| 670-739 | Good |

| 580-669 | Fair |

| 300-579 | Poor |

Also Read: Credit score 650