The simple answer to the question is that real estate appreciates due to inflation. As there was more money circulating out there with limited amounts of property each property is going to be worth more. However, that doesn’t explain why today’s real estate prices have gone from four times the average income in the 1990s to nearly eight times the average income today.

Is this because real estate matches inflation and incomes aren’t growing fast enough or is it because real estate is growing faster than inflation can keep up?

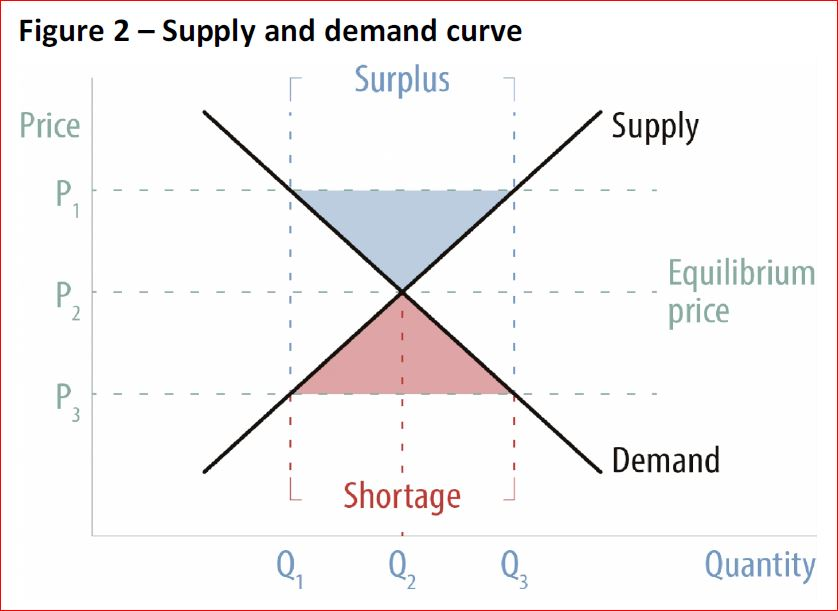

Supply and Demand?

Let’s take England for an answer; maybe the reason why prices outpaced incomes was that the population increased faster than the real estate Supply. Meaning of basic supply and demand rules apply where a limited Supply in an increased demand will cause the prices of an asset to go up.

However, this can’t be further from the truth. In fact, in 1991 there were 47 million people in England and 20 million homes. Fast forward to 2016 and now the population has increased by 16% and the real estate supply has increased by 21%.

This should mean that the price per person for a home should have at least been slower to increase than the incomes of individuals. Meaning that the price over income should have been less than it was before rather than more.

Maybe the explanation for this could be that more people want to live more alone, rather than start a family. In fact, they’re more westernized societies there seems to be a trend of getting married later, living in smaller family groups in units, and having smaller families.

However, even after all of these are taken into account The supply of homes still outpaces Demand by a couple of percentage points.

Therefore we need to look at something else to answer this question

Buy-To-Let

Buy-to-let is a British term, that also applies to the United States, that outlines how individuals use mortgage loans in order to purchase properties and then re-rent them out to other tenants.

This could be a major factor because in the last since 1991 this number has doubled today. This big increase in Well Finance buyers added a huge amount of extra demand, which could have fuel to the fire of gross and prices.

These help to buy schemes by the governments, could not only help boost the individual’s finances, but I’ve also kept prices really high on a long-term basis. In addition in order for prices to be more in control or stagnant the government needed to build 300k to 350k new homes every single year.

However, the government never hit this quota in a single year since 1991 which meant that demand was outpacing supply, increasing prices dramatically.

Interest Rates

The probable most liable culprit for the surges and prices are the interest rates set by Banks all over the world. Over the last few decades, interest rates have been more and more ridiculously low. (here is an in-depth explanation of what happens when interest rates go down)’

looking at the levels we are at right now, we are in very low-interest economies, especially in the United States. Ultra-low interest rates make borrowing money a lot cheaper. This makes consumers more willing to borrow money to buy goods and services that they couldn’t previously afford at higher interest rates.

Let me put this in perspective a home pay for a $100,000 home could be $1,200 if your interest rates are 10%, however, if the interest rates are as low as they are right now in the United States at 1.75% they can be as low as $500. You can see how some people that used to be able to not afford a payment on a $100,000 loan can easily afford the same loan due to the lower interest rate.

This does explain to some extent the surge in buy-to-let in the previous section. According to the bank of England, the decline in interest rates “can account for all of the rising house prices.”

therefore for some Economist Answers are Pretty Simple, the rising property values and drops and property values are in some ways mostly caused by the rise in interest rates. However, this issue is so complex that a multitude of other sub-issues can occur that we have not considered yet.

This basically means that we should attribute most of the blame to interest rates and inflation since they are inversely correlated (as you increase interest rates there will be a decrease in inflation and vice a versa), but there are other factors that can also affect it.